Fraud Alert! The CTA and BOIR are Real Form 4022 is a Scam

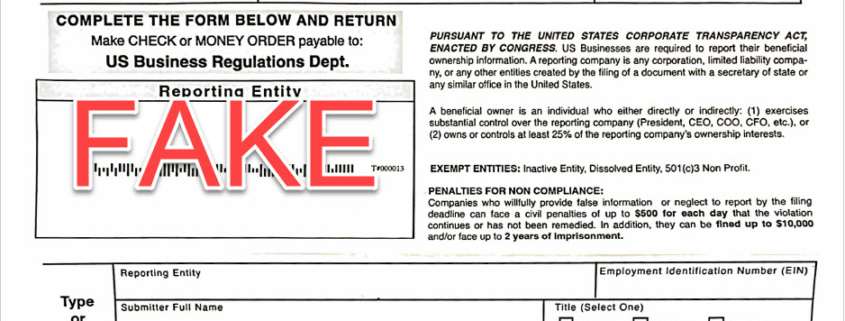

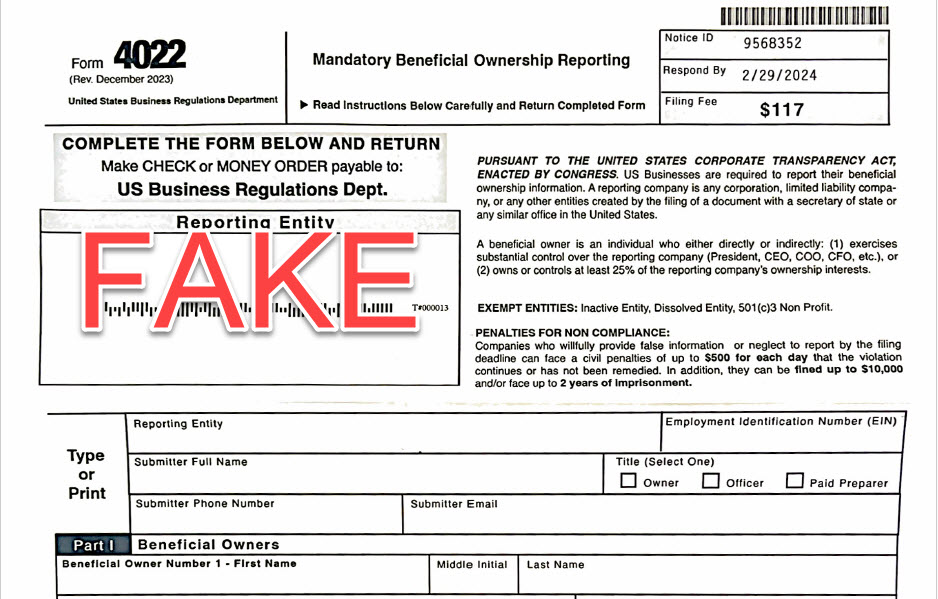

There is no such thing as Form 4022. I never charge clients to review official-looking forms they get in the mail or via email that demand payment of money, and good thing. Recently a client received in the mail a form (see image below) demanding $117 by the end of the month to comply with Mandatory Beneficial Ownership Reporting. It has the layout and look of an official IRS form, similar to tax filings, but it is not an official IRS form, or anything else affiliated with the Federal Government.

There is no such thing as the “United States Business Regulation Department.” Or at least, it is a fake scammer group and not an arm of the Federal government. Do not pay them $117 or any amount of money. Like many scammers, they rely on the trifecta of adopting an official-sounding name, threatening penalties for non-compliance, and setting a quick deadline. Their hope is that you will be so scared when you get this official-looking document that you will immediately send the information and pay, without consulting a lawyer or other advisor.

So is there really a Corporate Transparency Act (CTA)? Yes, and there is actually a requirement that all for-profit entities identify all of their beneficial owners who own 25% or more of the entity in a report to the Federal government. The Corporate Transparency Act (CTA), effective January 1, 2024, requires all for-profit entities — even single-member LLCs — to file what is actually called a Beneficial Ownership Information Report, or BOIR. If you use this form and send them a check, it is unclear whether these bad actors intend to actually file a BOIR on your behalf. But what is clear is that they will now be privy to a lot of very private information about you, setting them up to now steal your identity or compromise your business bank account (if you send a check). The real BOIR form requires you to submit each owner’s name home address, and copy of an identifying document, such as your driver’s license or passport. But there is no fee to file.

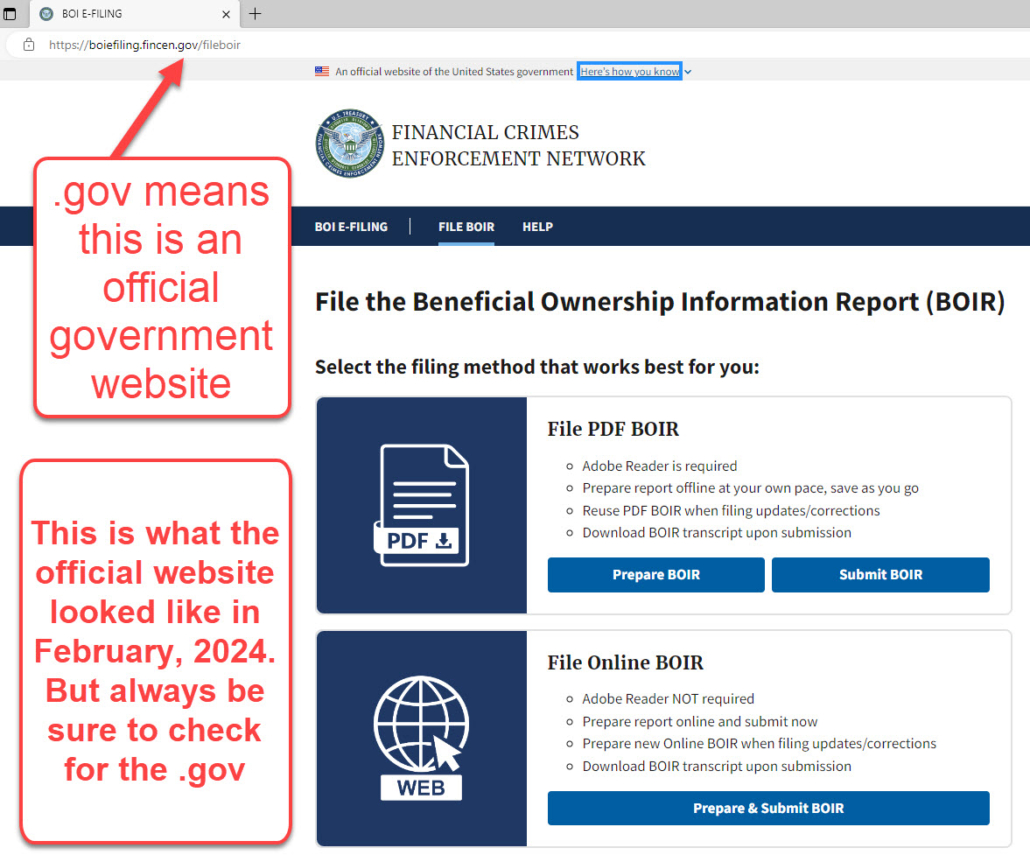

How do I comply with the CTA? If your business existed before January 1, 2024, you need to make your first disclosure filing with the Financial Crimes Enforcement Network, also known as FinCen, no later than January 1, 2025. So you have a little time, but don’t miss it! For any business formed after January 1, 2024, you need to file within 90 days of business formation. There are two options for filing — you can fill out a government-provided pdf form and upload it, or prepare the document fully online. The first time you do it, you won’t have a “FINCEN ID” (a unique number given to all individuals who own 25% or more of a legal or beneficial share of an entity) but you will be assigned one, and should use that ID number for future filings if you are affiliated with more than one business, Either way, be sure to follow the instructions carefully and save a “transcript” of the filed document so that you are able to prove your compliance if challenged.

Do I have to do this every year? No. Filing the BOIR is a one-time thing, so long as the ownership of your business does not change. If the ownership does change, you are required to file an updated BOIR within 30 days of any change, or within 30 days of finding any error. And the part about the penalties for not filing is real — you really can be fined civil penalties of no more than $500 for each day you are in violation, or even be jailed or fined up to $10,000. So do take this seriously, but don’t get scammed.

What if I need help with my BOIR? Feel free to reach out to us if you need assistance with the form. We are happy to help. But if you want to do it yourself, be sure you are on the official government website, https://boiefiling.fincen.gov/fileboir. That .gov is key — that shows you it is an official government website. Here’s what the official website currently looks like (and if you click the image, it will take you to the real deal:

If you need help, contact us.

December 2024 Update: A Court has enjoined enforcement of the CTA, and therefore the January 1, 2025 deadline to file a BOIR is currently suspended, and no one is required to comply. Please see our related post.

DPW Legal

DPW Legal

Public Domain Per Flickr User Szántó

Public Domain Per Flickr User Szántó